Income Tax Ea Form Malaysia

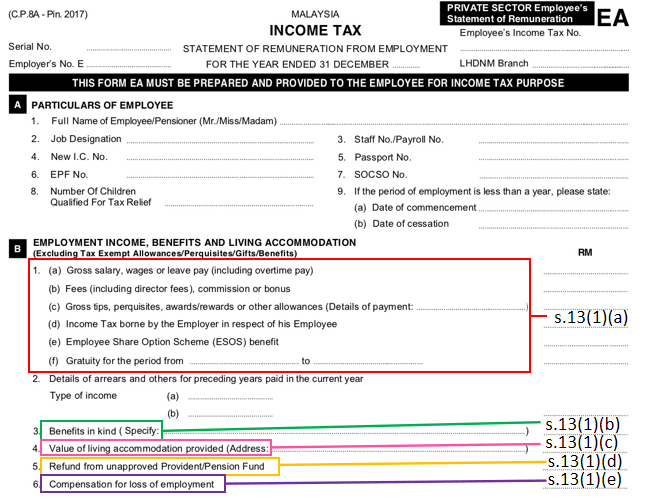

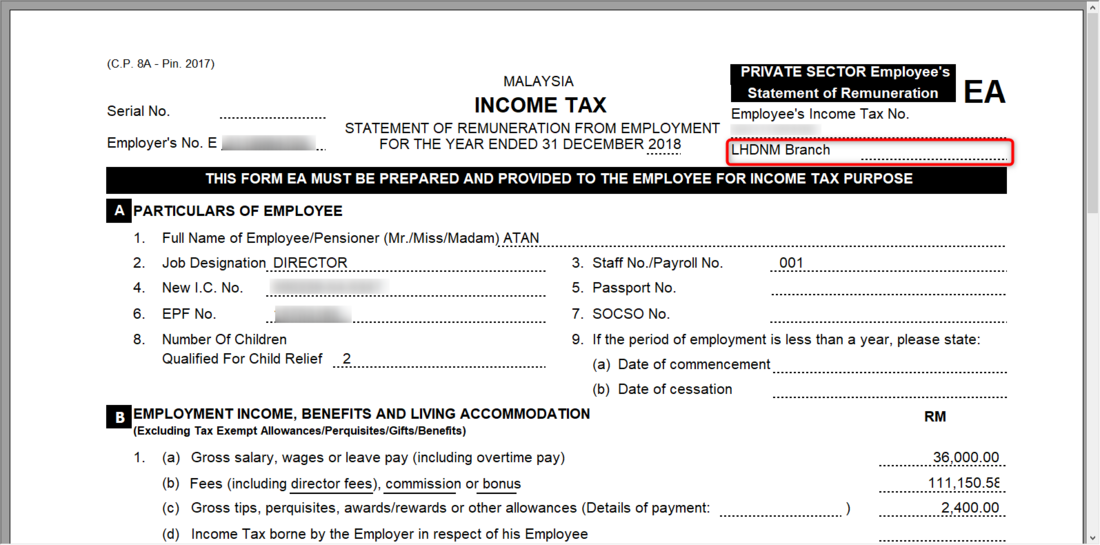

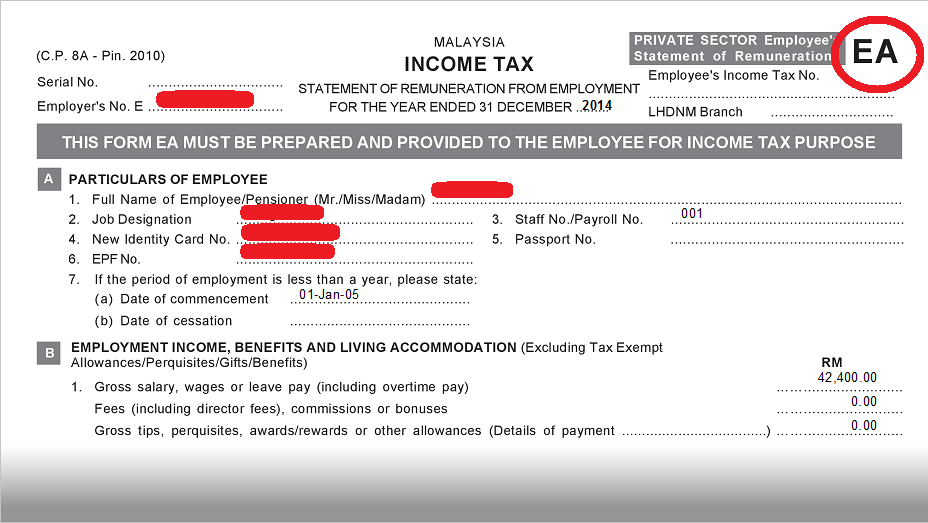

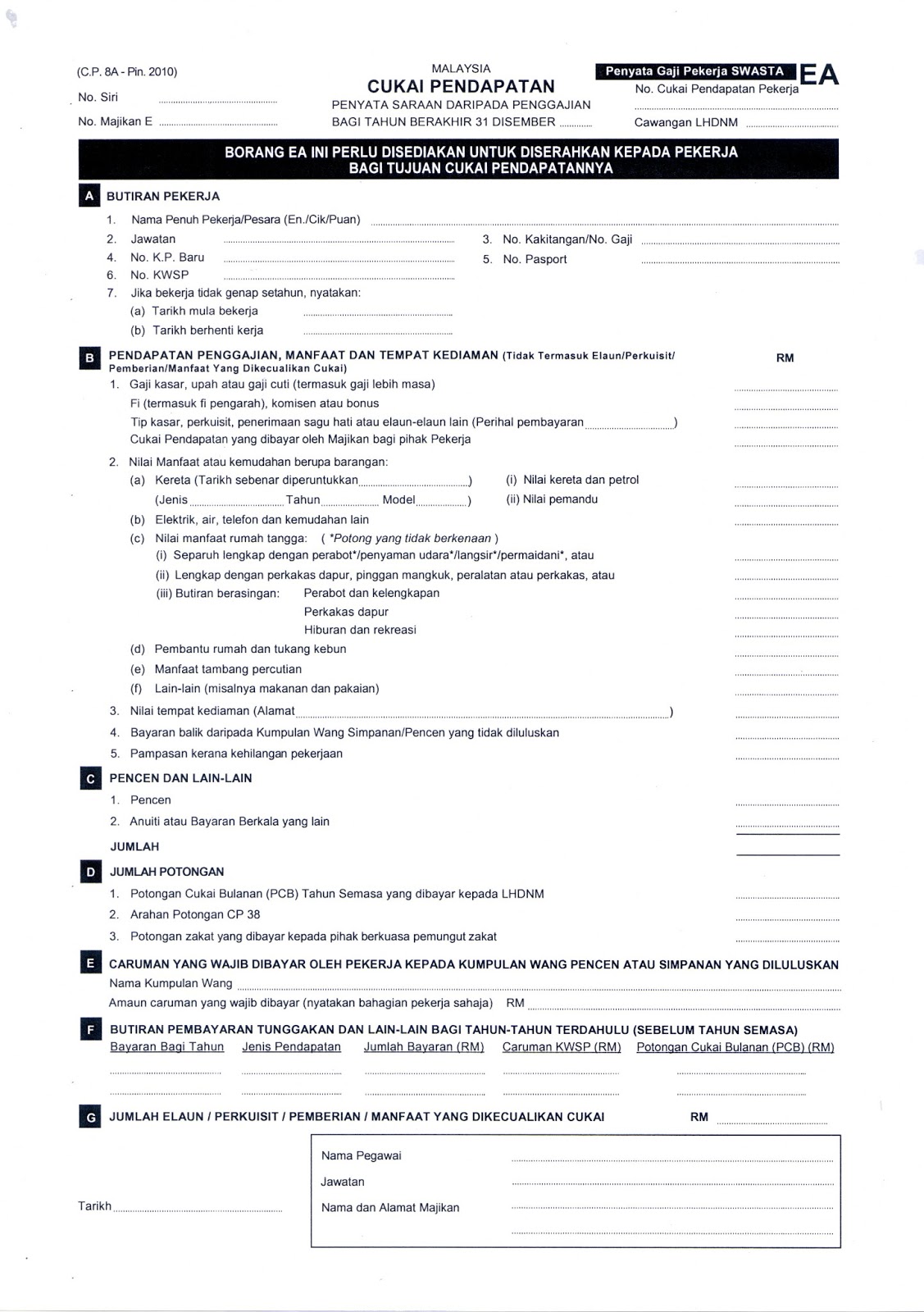

According to the inland revenue board of malaysia an ea form is a yearly remuneration statement that includes your salary for the past year.

Income tax ea form malaysia. Now s the time to make sure all your details are correct. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. You will usually use this form to file personal taxes during tax season.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Malaysia income tax statement of remuneration from employment. 4 check those details. Here is a list of income tax forms and the income tax deadline 2019.

Choose the right income tax form. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year. Part f is where you can file for tax exemptions on certain perquisites and benefits in kind thereby reducing your overall chargeable income. 4 minutes it s tax filing season and time to file for tax exemptions in part f of form ea after all you do not want to overpay your taxes.

For everyone who has no idea what ea forms are let us break it down for you. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. For individuals with no business income make sure to choose income tax form be e be and choose the assessment year 2016. To begin filing your tax click on e borang under e filing.

Once you click on e form you ll see a list of income tax forms. Do keep in mind that you re filing for 2016 income tax in 2017. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

Once you ve logged in you will be shown a list of features available on e filing.